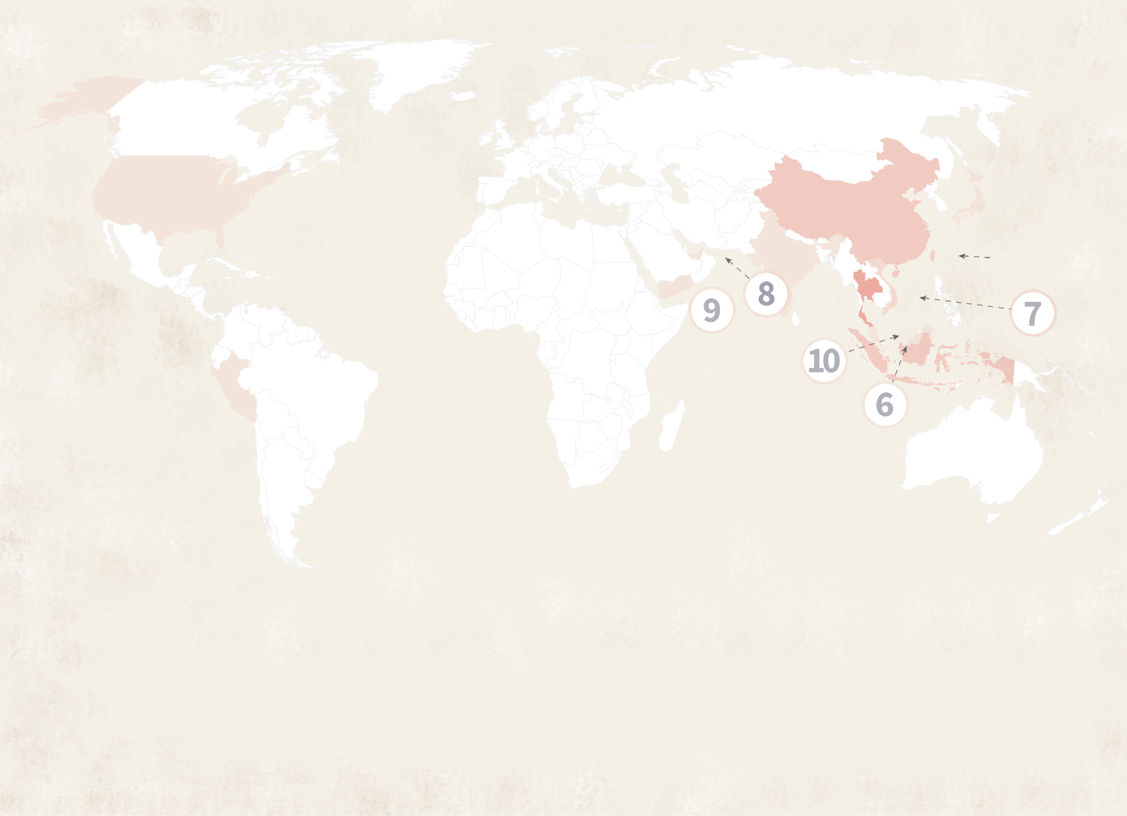

Historically, Hong Kong has been the most important trader of shark fins in the world, accounting for the majority of recorded imports and the world’s largest exporter since the late 1980s.

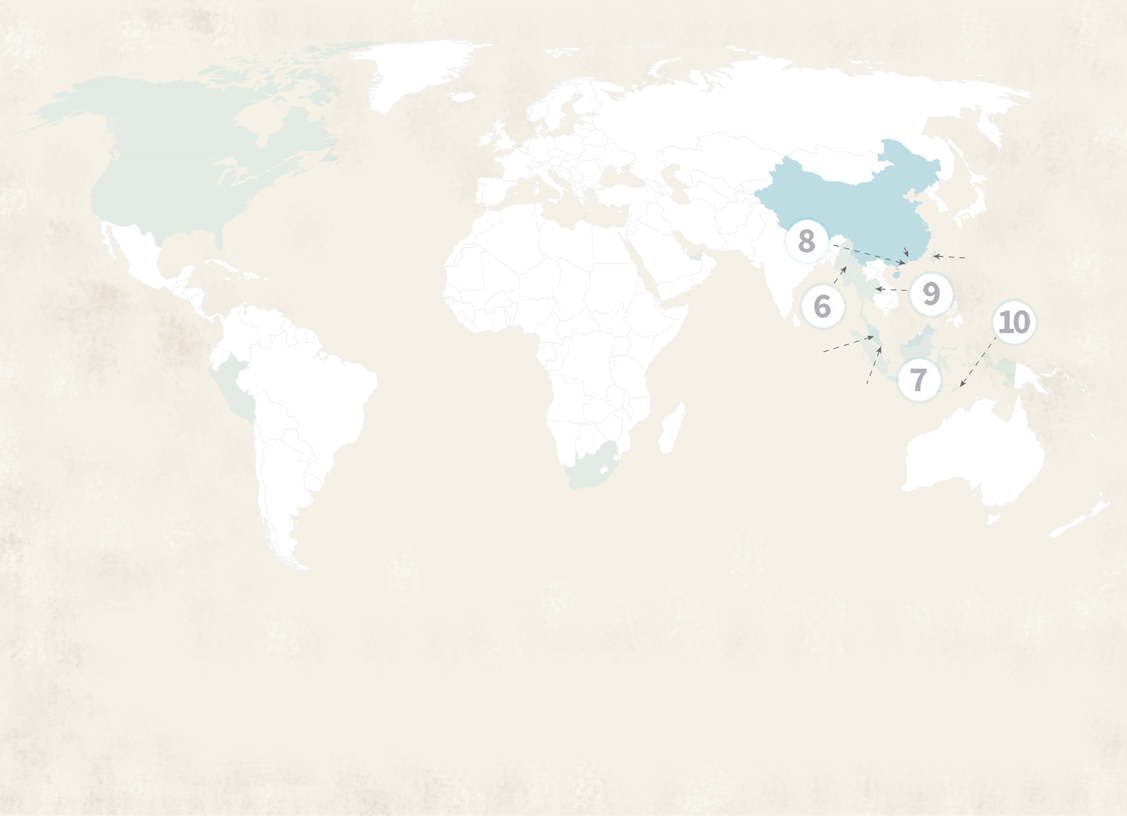

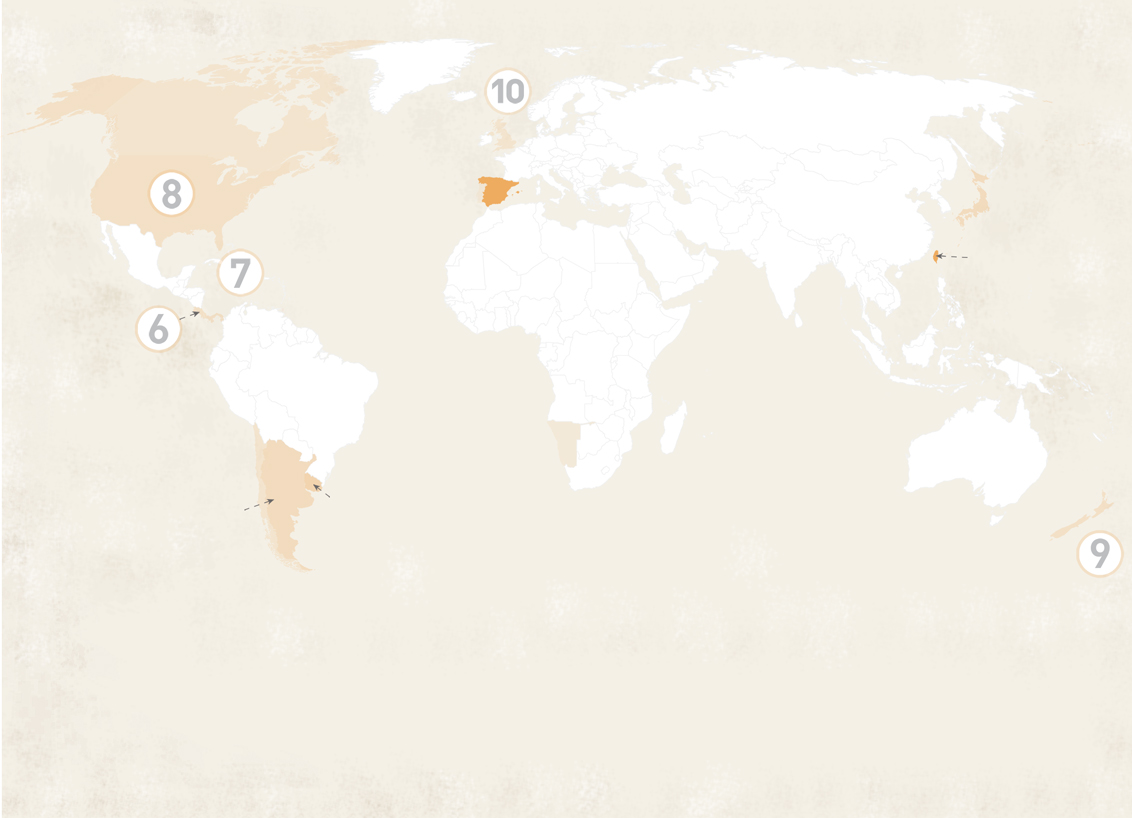

Take a closer look at the top importing and exporting countries in the shark fins trade.

exporters

exporters

importers

importers

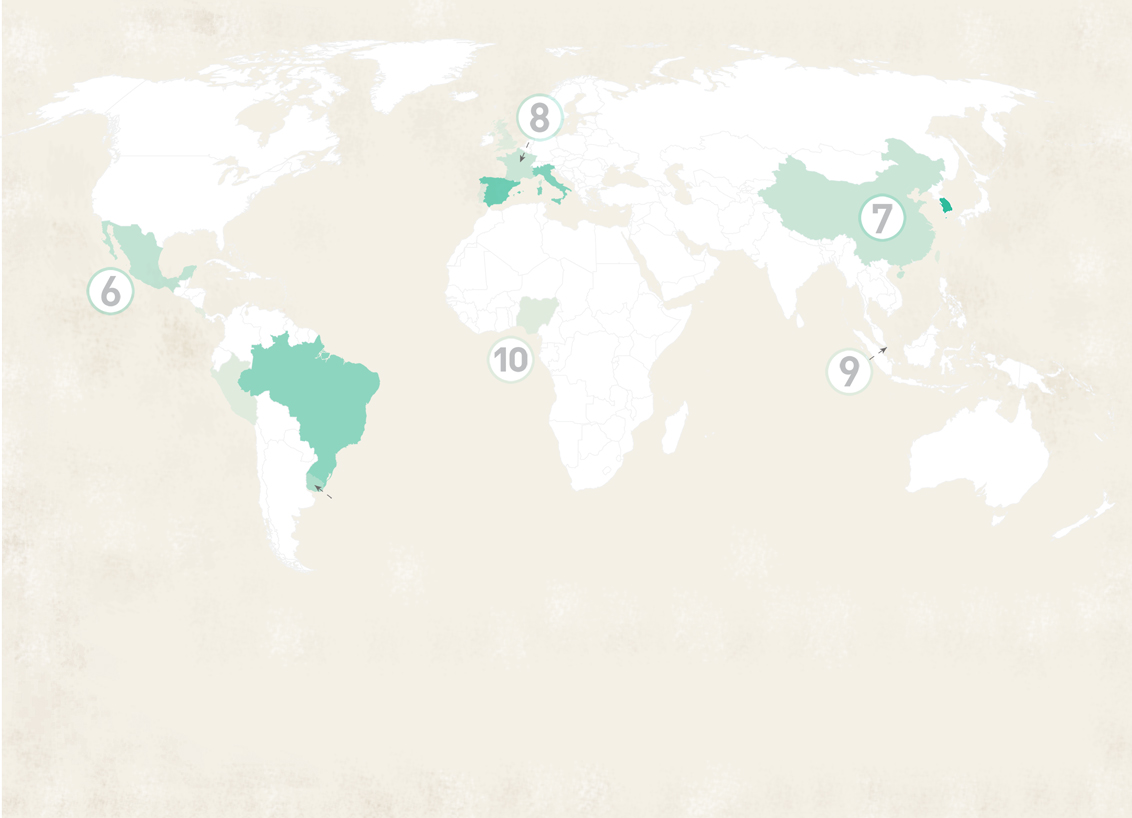

Take a closer look at the top importing and exporting countries in the shark meat trade.

exporters

exporters

importers

importers